By using our website, you agree to the use of cookies as described in our Cookie Policy

Ready to apply for business funding?

Start our simple online application now.

February 4th, 2025•21 min(s) read• by Abe Silverman

Last Updated: January 09, 2026

Business owners often face situations where they need capital quickly. A supplier may require immediate payment for a bulk order, or an unexpected equipment failure may require urgent replacement. In these cases, waiting several weeks for a traditional business loan to process may mean missing important opportunities or facing operational disruptions. Same day business loans aim to address this specific timing challenge by providing funding within hours rather than weeks.

The timing gap between when businesses need funds and when traditional banks can provide them has grown even more significant in 2025. The Federal Reserve's latest report on employer firms shows that banks have increased their approval requirements and extended their underwriting timelines. Meanwhile, business expenses and opportunities continue to operate on shorter timelines. Same day business loans exist to bridge this timing difference, helping businesses access capital when traditional loan processing schedules do not align with immediate needs.

Same day business funding is not designed to replace traditional financing options such as SBA loans, equipment financing, or standard term loans. It's primary function is to provide small business owners with a way to address urgent capital needs, take advantage of time-sensitive opportunities, and maintain stable cash flow when waiting for traditional loan approval would create more problems than the cost of faster financing.

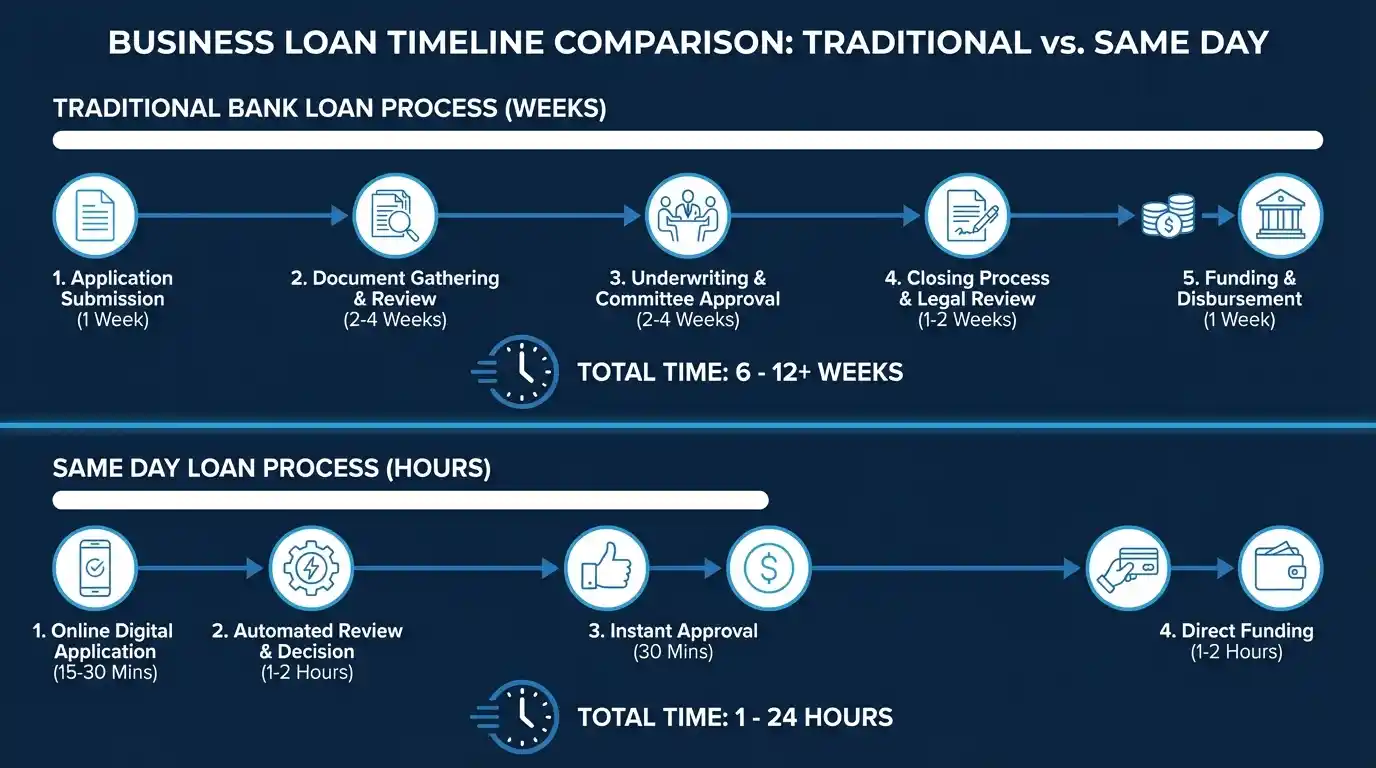

Same day business loans use a different processing approach than traditional lending. Traditional loans typically require weeks of review and documentation. Same day loans reduce this timeline to hours by using automated review systems and digital applications. Lenders focus on recent cash flow data rather than extensive historical records, since current revenue patterns provide a clearer picture of a business's ability to handle repayment. The faster timeline comes with higher costs and shorter repayment periods.

These loans are typically categorized as short term business funding. The approval process focuses on recent banking activity, current revenue trends, and basic business verification rather than detailed collateral analysis. Lenders primarily need to answer one question: Can the business manage the payment schedule without creating cash flow problems?

Common characteristics of same day small business loans include:

Instant business funding typically means decisions within 2 to 4 hours using automated systems that analyze connected bank or payment processor data. The term "instant" refers to the speed of the decision process rather than immediate fund transfer. Lenders still conduct identity verification, fraud screening, and basic compliance checks before releasing funds.

Same day business loans serve as a tool for addressing specific timing challenges in your cash flow rather than replacing your core financing structure.

They work best for urgent expenses, short-term opportunities, and temporary cash gaps. Think of them as a solution for immediate needs rather than a replacement for traditional business financing that supports long-term growth.

Approval criteria for same day business loans differ from traditional bank requirements. Rather than emphasizing credit scores and collateral primarily, instant business funding programs focus significantly on current cash flow and banking history. Lenders evaluate whether revenue comes in consistently and whether the business can manage frequent payment deductions.

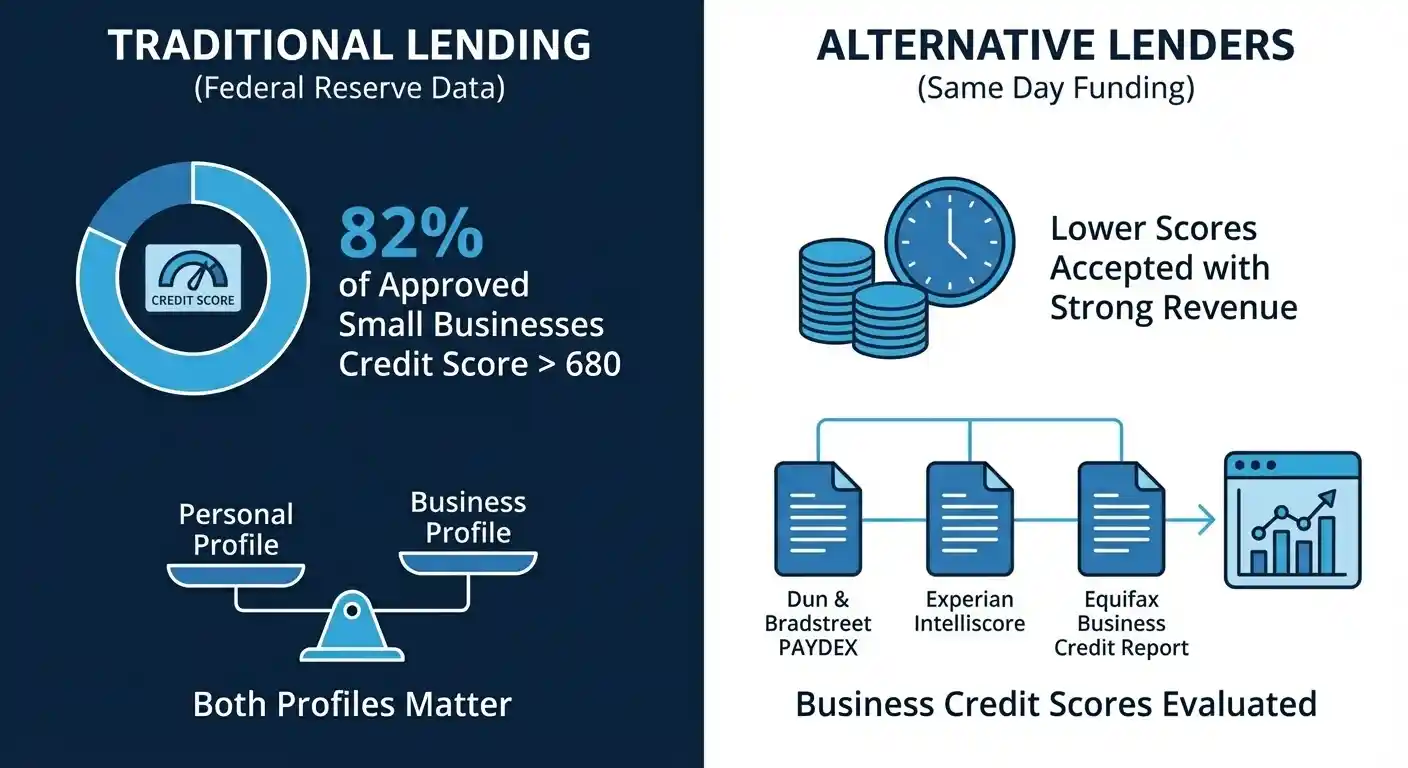

Minimum operating history requirements usually range from six to twelve months. Lenders also look for consistent monthly revenue and active business banking with sufficient transaction history to assess patterns. Personal credit scores are typically reviewed, but a score below 680 does not automatically result in denial when revenue demonstrates strong, consistent performance.

Federal Reserve data indicates that 82% of approved small businesses maintained credit scores above 680, though alternative lenders providing same day business funding often approve businesses with lower scores if revenue is consistent. Lenders review both personal and business credit profiles, using business credit scores from Dun & Bradstreet PAYDEX, Experian Intelliscore, or Equifax Business Credit Report.

Typical requirements for instant business funding approval:

Business owners who maintain organized financial records and keep business finances separate from personal finances typically experience faster approval processes. Learning about business credit report criteria can help you understand your current position and identify areas for improvement before applying.

For businesses with personal credit below 650 but consistent business deposits, submitting applications on Tuesday or Wednesday can improve outcomes. Mid-week submissions typically receive more thorough review compared to Monday and Friday applications, which tend to generate quicker automated decisions with more conservative criteria.

See How Much Capital Your Business Can Access & Start Growing Today!

Apply Now

Not all financing products can be processed within a single business day. Some loan types require government backing, property appraisals, or extensive collateral evaluation. Other products are specifically designed for rapid approval and funding. Six main product categories provide same day business funding capability. Each addresses different business situations, carries different cost structures, and works for different operational models.

Understanding which product fits your situation:

Short term business loans represent one of the most frequently used structures for same day approval. These loans provide a specific amount with a defined repayment schedule spanning several months to one year. Payment frequency varies by lender and may be daily, weekly, or monthly.

Common uses include inventory purchases, bridging receivable gaps, or covering urgent operational expenses. The shorter term length allows lenders to make faster decisions since they are not committing capital for extended periods.

A wholesale distributor receives notice of a limited-time opportunity to purchase $75,000 in inventory at 40% below market price, with the offer expiring in 48 hours. A short-term loan provides same-day funding, with daily payments beginning immediately. The loan is repaid over 9 months while the inventory sells at standard margins. The profit margin from the discounted inventory exceeds the financing costs.

A revolving credit structure offers flexibility for many business owners. A business line of credit establishes an approved borrowing limit that can be drawn from as needed. Some providers approve and fund initial draws on the same day, particularly when they connect directly with business bank accounts.

Lines of credit are effective for managing recurring cash flow gaps, smaller projects, or brief opportunities. Interest charges apply only to the amount used, which can be more cost-effective than repeatedly taking full loan amounts when working capital needs arise.

Businesses with significant card transaction volume may use a merchant cash advance for quick funding access. Rather than fixed payment amounts, the provider collects a predetermined percentage of daily card sales until reaching the agreed repayment total. This structure automatically adjusts to sales volume fluctuations.

Merchant cash advances are not technically classified as loans but function similarly for managing cash flow. Approvals often occur within hours on the same day, based on recent card processing records and banking activity.

These products are increasingly marketed as revenue based financing, which connects repayment directly to income rather than fixed schedules. While merchant cash advances traditionally focus on card transactions, modern revenue based financing programs can include multiple revenue sources, expanding access beyond retail and food service businesses.

A restaurant requires $30,000 for critical kitchen equipment replacement before the busy summer season. A merchant cash advance provides same-day funding with repayment set at 12% of daily card sales. Higher sales volumes during peak months accelerate repayment, while slower periods automatically reduce the payment burden. The equipment investment generates returns within the season.

Businesses with extended customer payment terms can access same day business funding through invoice factoring. Rather than waiting thirty, sixty, or ninety days for customer payments, businesses sell approved invoices to a factor at a discount. Many factoring companies advance funds within 24 to 48 hours after establishing the relationship.

This approach works particularly well for businesses that invoice other companies, including manufacturing, logistics, and professional services firms. It does not create new debt. It provides an advance on revenue that has been earned but not yet collected.

A staffing agency maintains $200,000 in outstanding invoices from corporate clients with 60-day payment terms but needs to process weekly payroll. Invoice factoring advances 85% of invoice value within 24 hours, with the remaining 15% minus fees paid when clients settle invoices. Cash flow stabilizes immediately without adding debt obligations.

Secured financing typically provides lower interest rates than unsecured options and often allows longer repayment terms. Bank of America reports that unsecured loans generally limit terms to approximately five years, while secured loans can extend significantly longer. Acceptable collateral includes equipment, real estate, inventory, or accounts receivable. Lenders frequently require a personal guarantee where the business owner personally backs the loan, which can improve approval probability and terms even for same day business funding products.

Many lenders evaluate potential recovery options through general UCC liens even on unsecured same day loans. Businesses with valuable equipment or strong receivables often receive better terms regardless of formal collateral requirements.

Some longer-term products process faster than commonly expected. Certain equipment financing programs can move quickly when vendor information, asset documentation, and required paperwork are ready. Equipment purchases up to $50 million can be financed with flexible repayment options spanning 5 to 20 years. These products require more involvement than short-term loans but may fund within days rather than weeks.

By contrast, SBA loans and traditional long term loans rarely qualify as same day options. They are more appropriate for planned projects, business acquisitions, and major expansions where processing time is available.

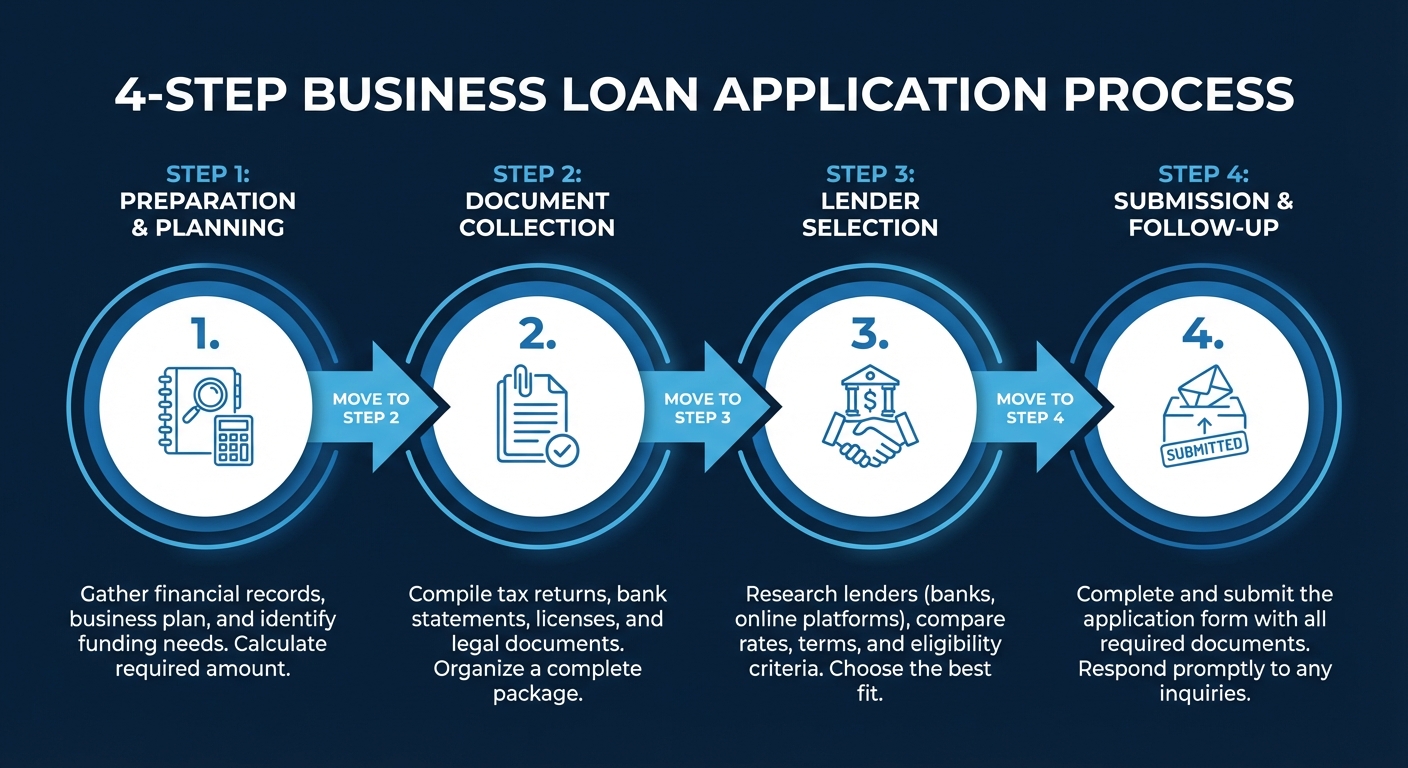

Understanding available options represents the first step. Successfully obtaining same day approval requires advance preparation rather than reactive attempts. The distinction between receiving funds in hours versus remaining in underwriting review typically depends on four controllable factors that can be addressed before submitting an application.

Quick financing outcomes require proper preparation. Same day business loans become possible only when lenders can review clear, complete information without processing delays. Applications submitted with missing information or unclear documentation slow the entire process.

Begin by clearly defining why instant business funding is needed and the duration of the need. Are you covering payroll for one month, purchasing inventory for a seasonal period, or addressing overdue vendor payments. Your specific situation should determine which product and term length you select.

Most same day small business loans require recent bank statements and basic financial documentation. Preparing these materials in advance eliminates processing delays. While many lenders now access data directly from your accounts, understanding what information they will review remains valuable.

Many applications encounter problems due to common approval mistakes that proper preparation can prevent.

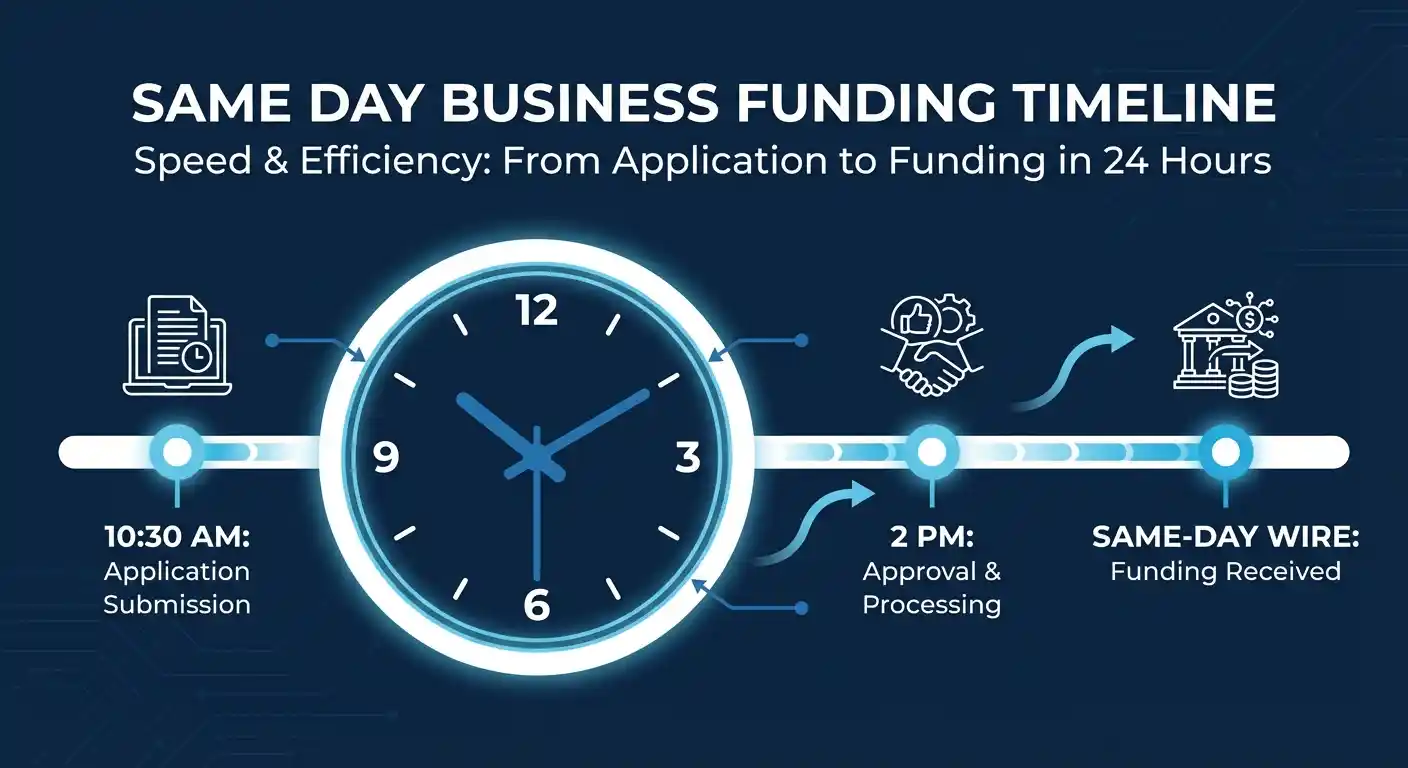

Applications submitted before 10:30 AM EST typically receive priority for same-day processing, as lenders often batch process applications and schedule fund transfers during specific daily windows.

Not all lenders provide genuine same day business funding despite marketing that may suggest otherwise. Before applying, review their actual process, typical timing, and available products. Verify whether they offer short term loans, advances, or lines of credit, and confirm their standard funding timeline.

Selecting the appropriate product for your specific need is more important than simply pursuing the fastest available offer. Same day business loans should integrate into your overall funding approach rather than replace it entirely.

After selecting a lender, take time to ensure your application is complete. Most processing delays result from missing documents or inconsistent information. A well-organized application typically leads to faster approval and more favorable terms.

Lenders increasingly use automated decision systems combined with human review. The FDIC reports that a growing number of banks can approve straightforward small business loans within one to five business days, with some approving within one day, supported by technology and streamlined review processes for lower-risk applications. The FDIC's 2024 Small Business Lending Survey found that three out of ten banks can approve small loans within one business day, and three out of four within five business days.

Same day funding decisions completed before 2 PM EST generally result in same-day wire transfers. Approvals received after 2 PM typically fund on the next business day. Consider submission timing if this distinction matters for your situation.

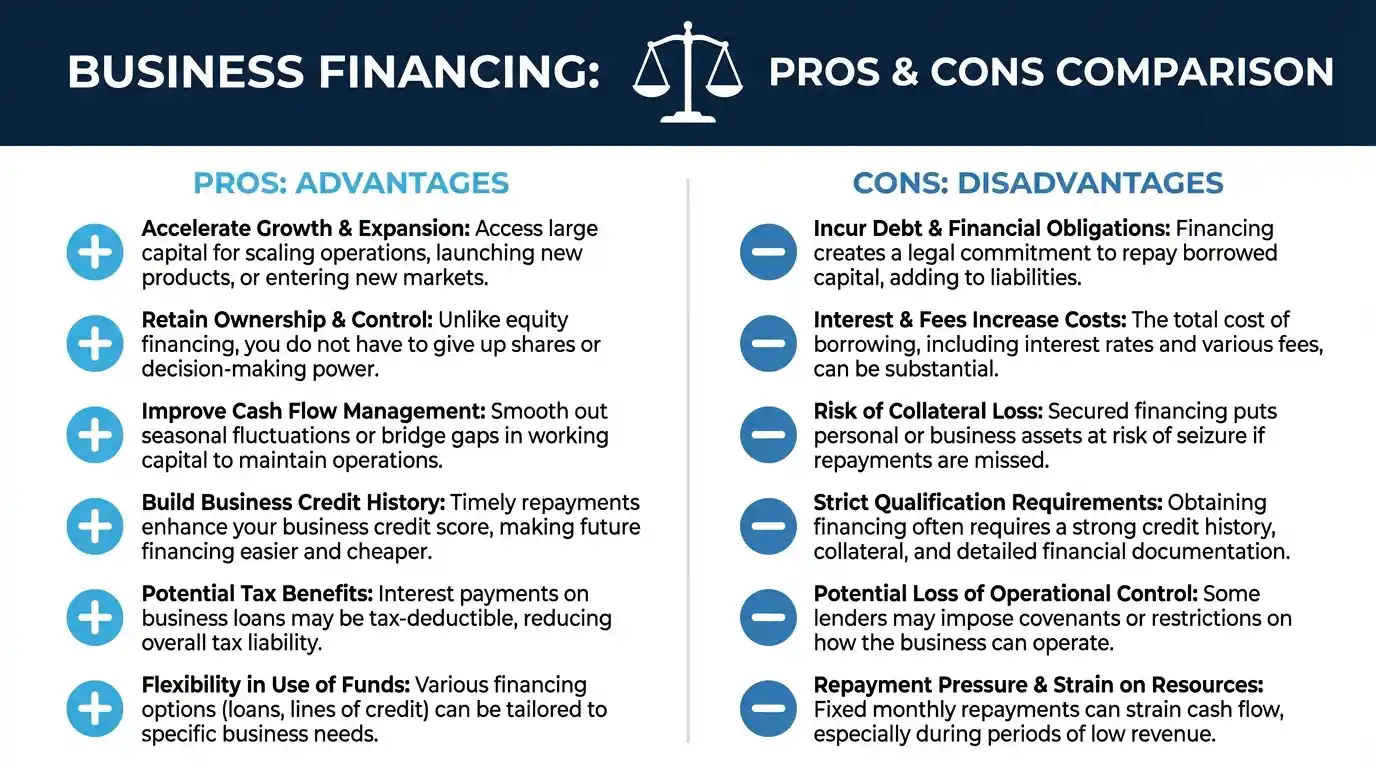

Same day business loans address a specific business challenge: they provide capital quickly when timing is critical. The trade-off involves accepting higher costs and shorter terms in exchange for receiving funds in hours rather than weeks. For businesses facing urgent opportunities or immediate cash needs, this trade-off often makes financial sense. For businesses with more flexible timing, it typically does not.

Understanding both advantages and disadvantages helps determine when instant business funding makes strategic sense and when waiting saves money.

Advantages of same day business loans

Disadvantages of same day business loans

| Feature | Same Day Business Loans | Traditional Business Loans |

|---|---|---|

| Decision speed | Hours to one day | Several days to weeks |

| Funding timeline | Same day or next day | After approval and closing |

| Typical term length | Three to eighteen months | Two to ten years or longer |

| Payment frequency | Daily, weekly, or monthly | Usually monthly |

| Cost of capital | Higher | Lower |

| Best use case | Short term cash gaps and urgent needs | Long term projects and larger investments |

Reviewing these trade-offs side by side clarifies the appropriate role of instant business funding. It serves specific purposes rather than replacing well-structured, lower-cost business funding that supports sustained growth.

Not all businesses meet the requirements for same day small business loans. Revenue history may be too limited, financial patterns may need more consistency, or lenders may require additional stability before approving rapid financing. This does not eliminate all funding options.

Many business owners benefit from improving their financial structure before reapplying. Organizing bank activity, reducing minor outstanding debts, or establishing clear separation between personal and business finances can improve future approval outcomes. Meanwhile, alternative products may better suit the current situation.

Alternative options to instant business funding:

Each alternative has distinct requirements and timelines. For instance, a business with substantial receivables might obtain faster relief through invoice factoring than through a same day business loan. A company planning a significant purchase might benefit more from SBA financing or a structured long term loan than from multiple short-term advances.

If timing rather than creditworthiness creates the challenge, it may help to examine how you manage seasonal fluctuations and advance planning. Preparing for seasonal cash flow can help develop a strategy so that future fast funding decisions are made proactively rather than under pressure.

Same day business funding products serve a wide range of industries, each facing distinct cash flow challenges and capital requirements. Whether operating a restaurant or catering business with inventory and seasonal demands, running an e-commerce operation during growth phases, or managing a healthcare practice with delayed insurance reimbursements, fast business funding can address critical timing gaps.

Same day business loans prioritize speed, and that speed comes with tradeoffs in cost and repayment structure. These products are designed for short-term cash flow needs, not long-term financing.

Rates and costs vary by product type, business profile, and funding speed. Short-term loans and lines of credit are typically priced using APR, while merchant cash advances are priced using a factor rate rather than interest. As a result, costs may appear higher than traditional bank or SBA loans when annualized.

Repayment terms are usually shorter, often ranging from a few months up to 24 months, with payments made daily or weekly in many cases. This frequent repayment schedule can impact cash flow, especially for businesses with thin margins or inconsistent revenue.

Same day funding can make sense when timing is critical and the return on capital clearly outweighs the cost. It may not be the right fit for long-term investments, low-margin businesses, or situations where slower, lower-cost financing is available. Understanding how repayment frequency and total cost affect your cash flow is essential before moving forward.

In many situations, yes. When documentation is prepared and you meet lender criteria, some programs can approve and transfer funds on the same business day. Timing frequently depends on application submission time, file complexity, and response speed to follow-up requests.

Limits vary by lender, revenue level, and industry. Many same day business loans begin around five thousand dollars and can extend into the low six figures for businesses with strong, consistent cash flow. Lenders typically set maximum amounts as a percentage of average monthly revenue.

Requirements vary. Many short-term programs are unsecured or use a general lien on business assets rather than specific collateral. Larger fast funding arrangements may require a personal guarantee or liens, particularly for newer businesses or higher-risk industries.

Most providers conduct at least a soft credit check. Some may perform a hard inquiry, especially for higher credit limits. The more significant impact comes from payment performance. Consistent on-time payments can benefit your credit profile over time. Missed payments or defaults will damage it. Managing payment obligations within your financial capacity matters more than the initial credit inquiry.

Generally not. Same day business loans are structured for short-term needs. Long-term projects such as major expansions or real estate investments typically fit better with products like SBA loans, traditional term loans, or structured equipment financing. These require longer underwriting but are designed to match multi-year repayment periods.

Fast-growth companies frequently use same day funding strategies that align with revenue cycles, while short term loan structures differ considerably based on repayment schedules and cost factors. The U.S. Small Business Administration provides a comprehensive directory of traditional loan programs for comparison purposes. When ready to compare actual offers, you can begin a request and work with a specialist who can explain your options clearly.

Same day business loans and instant business funding are financing tools. When used with clear planning, they can protect cash flow and maintain business operations when timing becomes critical. Without planning, they can become costly and create additional stress. Success depends on preparation, appropriate product selection, and realistic financial analysis before committing.

If you are considering same day business funding, same day business loans, an instant business loan, fast business funding, or similar products, the next step is converting this information into a practical plan. The objective is not simply obtaining approval, but selecting the appropriate product, avoiding unexpected issues, and maintaining stronger business finances after receiving funds.

Begin by analyzing your cash requirements for the next ninety days. Document major expenses, anticipated receivables, and any identified risks. This short timeframe is where fast financing provides the most value. When you identify gaps, document the amount needed, timing requirements, and realistic repayment capability without affecting payroll or vendor relationships.

Next, compare business funding options. If the need relates to a specific project or purchase, evaluate whether a short term loan, line of credit, or merchant cash advance provides the best structure. The primary distinctions between fast funding and traditional loans typically involve approval speed versus overall cost, making structure selection as important as the borrowed amount.

Industry considerations also matter. A restaurant or catering business may benefit more from card transaction-based products like merchant cash advances and restaurant funding programs. An online retailer might combine a line of credit with e commerce business funding designed for inventory cycles. A medical or healthcare practice might focus on cash flow stability while managing delayed insurance reimbursements.

After determining product fit, gather documentation and calculate sustainable payment amounts for daily or weekly deductions. Use conservative estimates. If the structure only works under ideal conditions, it is likely too aggressive. Fast financing should reduce pressure rather than increase it.

When ready to proceed, complete these three steps:

The application process typically requires 5 to 10 minutes of your time. For same day business loans, thorough preparation produces better results than rushed applications. Well-organized submissions receive faster, more accurate responses.

With over $5 billion funded and an A+ BBB rating, BusinessCapital.com offers transparent processes, quick decisions, and efficient processing.

Ready to get started? Complete our simple online application in 5 to 10 minutes or call 877-400-0297 to discuss your same day business loan options with a funding specialist.

This article is written and reviewed by the BusinessCapital.com editorial team to ensure accuracy, clarity, and relevance for small business owners evaluating financing options. Content is updated regularly to reflect current lending practices, market conditions, and regulatory considerations. BusinessCapital.com is a direct business funding provider, and some financing options discussed may be products we offer. Our goal is to provide transparent, educational information to help businesses understand their options and make informed financial decisions based on their specific needs and circumstances.

As a Finance Specialist at BusinessCapital.com, Abe plays a key role in our mission to simplify business funding. With access to over $5 billion in delivered capital and backed by our A+ BBB rating, Abe helps business owners secure quick funding through our 2-minute application process. His straightforward approach ensures clients get the financial solutions they need to keep their businesses moving forward.

March 25, 2025 •5 min(s) read

March 7, 2025 •3 min(s) read

Start our simple online application now.

Have questions?

Call us 877-400-0297

Sign up for our newsletter to get exclusive updates and offers

See what our clients have to say about their experience with us.

Call Us 877-400-0297

E-mail [email protected]

Headquarters: 221 West Hallandale Beach Blvd, #249

Hallandale Beach, FL 33009

BusinessCapital.com is a direct lender helping small businesses nationwide access the funding they need to grow. With over $5 billion funded to U.S. businesses and an A+ BBB rating, we offer a quick online application and fast decisions — making business funding simple, transparent, and stress-free.

*Same-Day Funding availability varies by state. Eligible applications must be submitted Monday-Friday before 10:30 AM EST. Applying for business funding won't impact your personal credit score. However, accepting an offer may result in a hard credit inquiry, depending on the product selected.

*Fund receipt time varies by product, with some as quick as 24 hours, though longer periods may apply.

*Depending on your state and application details, a minimum initial draw of $1,000 may be required.

*All loans are subject to lender approval.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BusinessCapital.com® is a Registered Trademark of Business Capital, LLC. All rights reserved.

By using our website, you agree to the use of cookies as described in our Cookie Policy